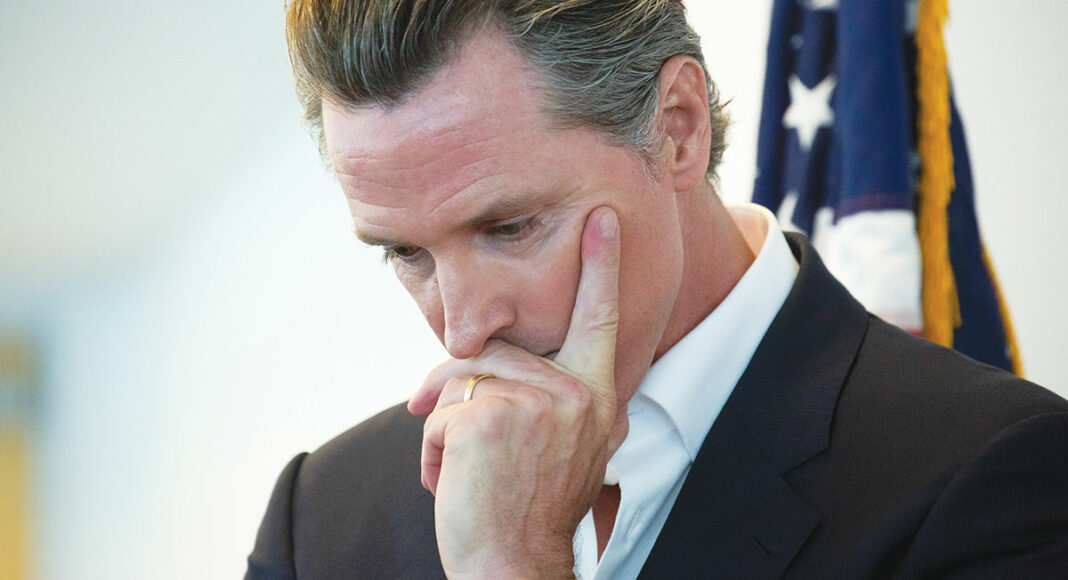

Gov. Gavin Newsom on Monday announced that the state will provide temporary tax relief for eligible businesses that have been impacted by Covid-19 restrictions.

Under the plan, taxpayers filing less than $1 million in sales tax receive an automatic three-month income tax extension. It also extends the availability of existing interest and penalty-free payment agreements to those with up to $5 million in taxable sales. It additionally provides taxable sales and expanded interest free payment options for larger businesses particularly affected by significant restrictions on operations based on Covid-19 transmissions.

The plan is estimated to have billions of dollars in impact, according to a press release from the governor’s office.

“California’s small businesses embody the best of the California Dream and we can’t let this pandemic take that away,” Newsom stated in the press release. “We have to lead with health to reopen our economy safely and sustainably while doing all we can to keep our small businesses afloat.”

According to Newsom’s office, small businesses create two-thirds of the state’s new jobs and employ nearly half of all private sector employees. California is home to 4.1 million small businesses, representing 99.8% of all businesses in the state and employing 7.2 million workers in California, or 48.5% of the state’s total workforce.

The pandemic has been especially hard on small businesses, with an estimated 44% at risk of shutting down nationwide, according to an August Small Business Majority survey.

And among those, minority-owned businesses are most impacted. According to a recent Census Current Population Survey, the number of active businesses owned by African-Americans dropped by 41%. The percentage of businesses owned by Latinx (32%), Asians (25%) and immigrants (36%) also dropped.

“California’s small businesses continue to struggle as a result of Covid-19, and this latest round of action at the state level will help bridge the financial gaps that are vexing our state’s mom-and-pop business owners and nonprofits while we wait for congressional action, and as we prepare for additional legislative action at the start of the year,” said Senate President pro Tempore Toni G. Atkins (D-San Diego) in a press release.

The tax relief plan is part of the state’s ongoing business support throughout the pandemic, including the Main Street Hiring Tax Credit, which authorizes $100 million in hiring tax credit for qualified small businesses. That credit is equal to $1,000 per qualified employee, up to $100,000 for each small business employer.

The application can be found here.

Newsom also announced the creation of a $500 million COVID Relief Grant. The California Office of the Small Business Advocate (CalOSBA) will administer the program at the Governor’s Office of Business and Economic Development.

It aims to help small businesses that have been impacted by the pandemic. Funds would be awarded to selected organizations with established networks of Community Development Financial Institutions to distribute relief through grants of up to $25,000 to underserved micro and small businesses throughout the state by early 2021.

Nonprofits would also be eligible for these grants.

CalOSBA is establishing the program and will make it available to small businesses as soon as possible. For updates on availability, click here.

Businesses interested in applying can learn more here: cdtfa.ca.gov/taxes-and-fees/SB1447-tax-credit.htm.